The ‘challenges’ of a healthy start with credit at Burlington H.S.

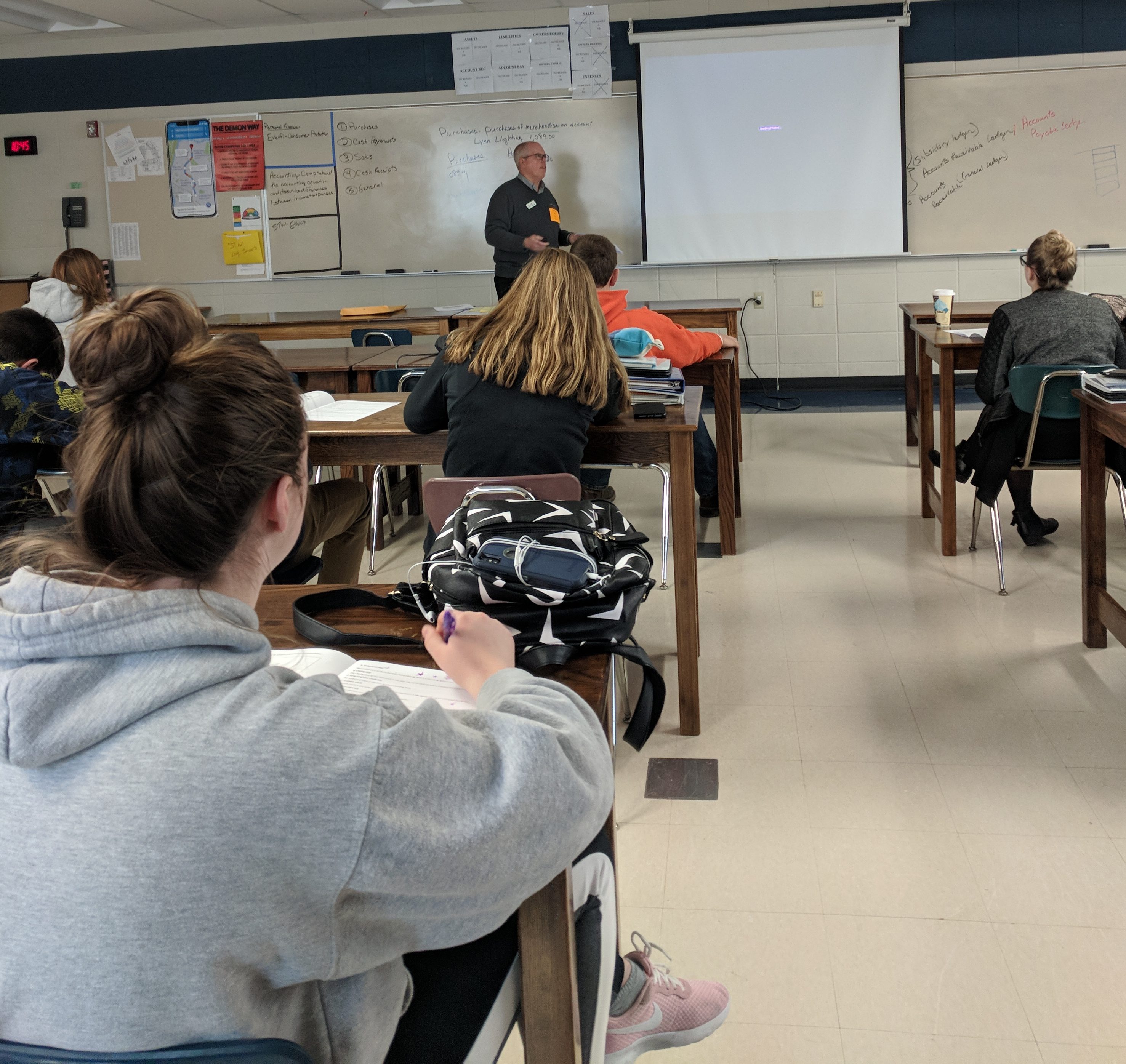

There were moments of quiet note-taking for teens at Burlington High School, then spikes of student questions, complex and fundamental, on aspects of credit. And in between those classroom peaks and valleys, Money Sense volunteer Dick Judd offered his “challenges.”

There were moments of quiet note-taking for teens at Burlington High School, then spikes of student questions, complex and fundamental, on aspects of credit. And in between those classroom peaks and valleys, Money Sense volunteer Dick Judd offered his “challenges.”

Judd challenged the juniors and seniors in educator Jade Gribble’s class to check bank statements regularly and, when they get a credit card, to only make purchases that can be paid off in full at months’ end.

“This will set the course for you into your older years. If you mess up your credit at a young age, it’s really hard to get out of that hole,” said Judd (in front at left), a marketing manager at Associated Bank.

“This will set the course for you into your older years. If you mess up your credit at a young age, it’s really hard to get out of that hole,” said Judd (in front at left), a marketing manager at Associated Bank.

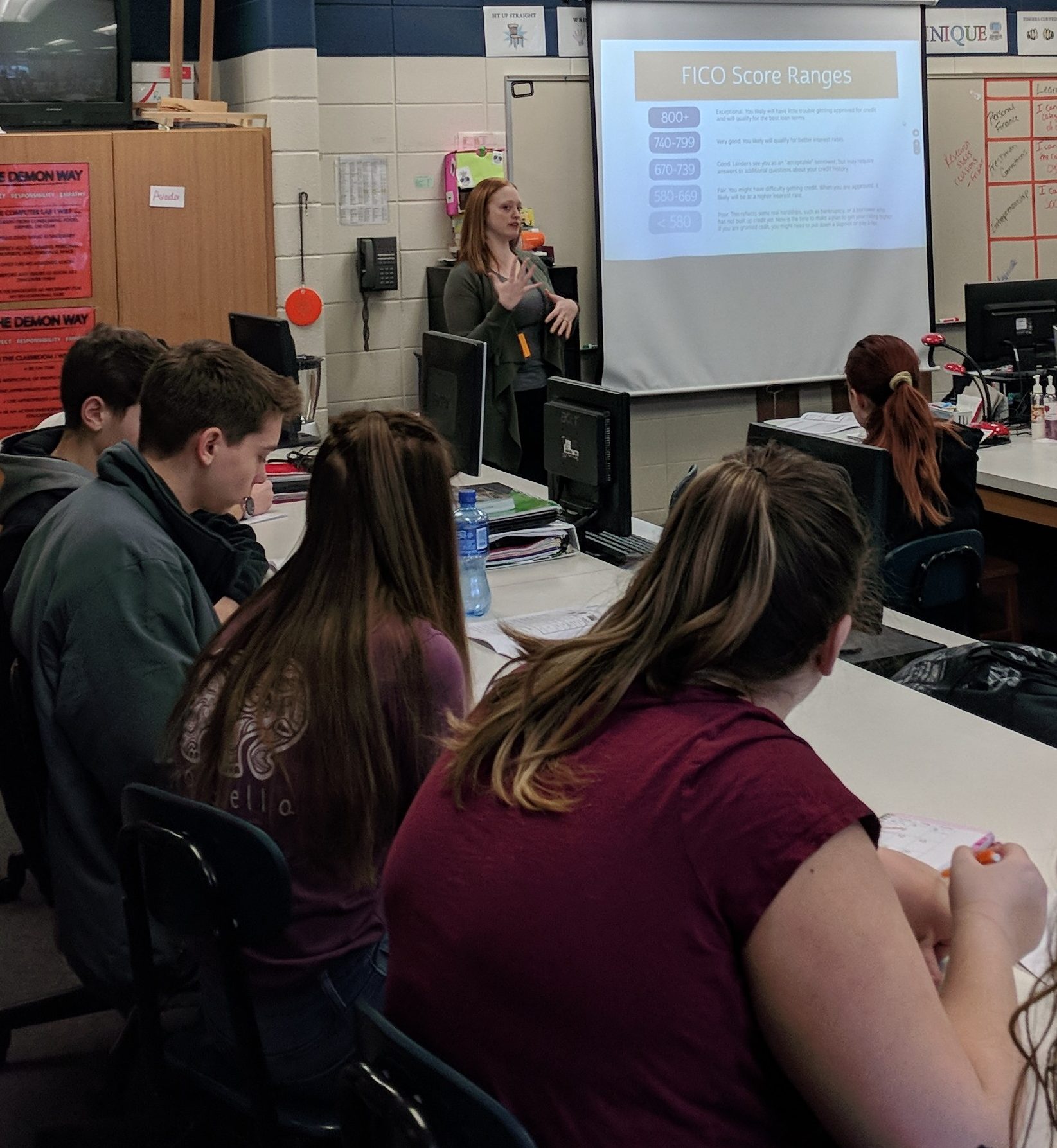

Gribble and fellow Personal Finance educator Jayme Pruszka invited Money Sense volunteers into their classes over the last month. For nearly 100 juniors and seniors, the Money Sense lessons have “connected nicely” with other coursework and additional detail, Pruszka said.

Volunteers in the past month have included Judd, Kathleen Walker (Shorewest Realtors), Bill Korducki (We Energies), Max Vos (Associated Bank), James Hauser (Tri City National Bank), Kendra Gabriel (BMO) and Teri Block (Associated Bank).

Walker, a first-time volunteer (at right), stoked students around the idea of interest sometimes outweighing the value of a product, like when loan or credit payments on a computer stretch out past four or more years.

“It’ll be outdated!,” remarked Jeff, a student, while shaking his head.

“It’ll be outdated!,” remarked Jeff, a student, while shaking his head.

Burlington has been a long-time partner of our Money Sense lessons, to add detail and complement the personal finance or economics requirements in place for teens. To that end, Gribble actively joined Judd in the credit conversation, including his warning to students about becoming “payment people,” those stuck with expensive long-term deals on cell phones or with minimum payments on credit cards.

The two encouraged students to listen their peer Monica, the only student in the class already using a credit card after her parents put her on their card as a teaching tool on spending and saving.

“It’s not like I could just spend whatever,” Monica said.

To find out more about Money Sense lessons and volunteers – especially with the new Wisconsin financial literacy mandate – contact our program manager Rashidah Butler-Jackson at rashidah@securefutures.org or (414) 273-8101.