Milton High School seniors plan a future with Money Path

May 22, 2020

At Milton High School, students learn how to plan. Beginning their junior years, each student at Milton puts together a detailed Academic and Career Plan (ACP) about their path post-graduation, which they then present at the end of their senior year. It’s the finalization of a grade 6-12 effort by the School District of Milton.

This year at Milton, as at high schools across the country, this exciting period of transition looks different than expected. Students have had to rethink many of their plans in light of the economic, health, and safety ramifications of the COVID-19 pandemic. Decisions that they made months or even years ago have to be reconsidered.

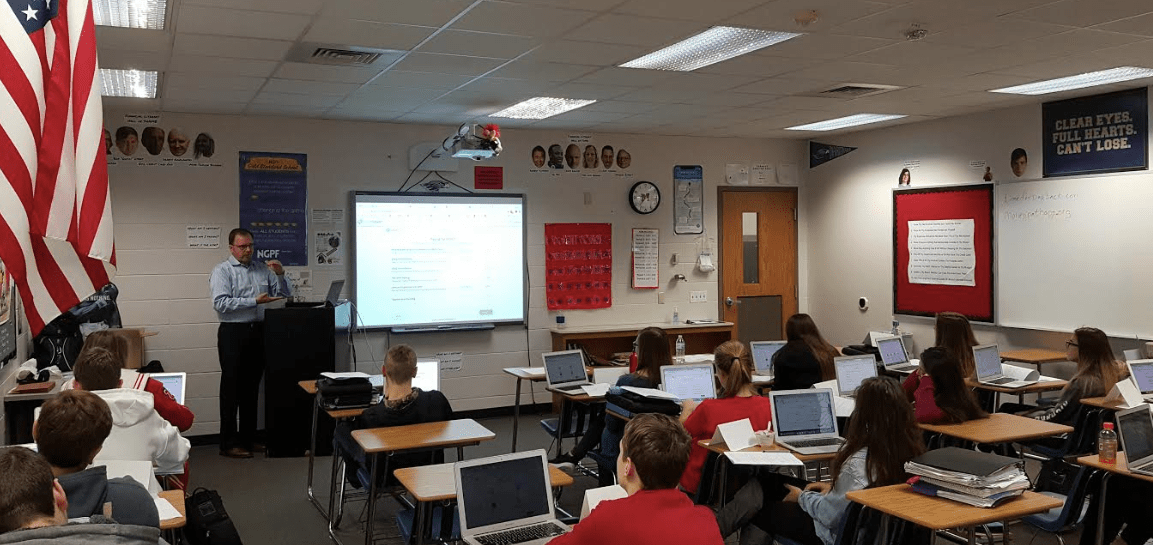

SecureFutures Business Director Pat Rorabeck presents Money Path at Milton HS earlier this year

Fortunately, Milton seniors have Money Path.

“In our classroom, the Money Path app is a vital tool in creating each student’s post-secondary plan, as they prepare for their Senior Academic Career Plan Presentation and the world beyond the walls of Milton High School,” said Milton Business Teacher Nic Manogue. “Pivot is the keyword utilized in our classroom: we know students will most likely consider changes in their plans as they move through life, therefore it is important for the students to be able to get the right information before pivoting their plans.”

Students at Milton are introduced to Money Path in their junior year as part of a semester-long Financial Literacy and Employment Skills course taught by Nic. It’s an integral part in preparing their ACP presentations; students must include 6 slides with screenshots of the path they have charted using Money Path.

Together, Nic, School-to-Career Coordinator Amy Kenyon, and a district team facilitate the Academic Career Planning process. Both consider Money Path a crucial tool, especially in light of the decision-making complications present during the time of COVID-19.

“Amy and I started to receive emails from students seeking assistance with the ACP and many of them, as expected, had a desire to change the plans that they had created as juniors,” Nic said. “Money Path was essential.”

Money Path’s fully web-based format also made it a particularly useful tool as educators got used to working within a virtual education environment.

“The COVID-19 pandemic has forced us to redesign our curriculum. Money Path helps reinforce many of the essential learning outcomes in our Financial Literacy course and aligns with our new reality of online education,” said Amy.

Milton senior Mandy Sullivan is one of the many Milton students who has found Money Path helpful in rethinking her plans for Fall 2020.

“Since it’s kind of up in the air as to whether classes will be virtual or in person, I started to sort of prepare for what my Plan B,” Mandy said. “I began looking into a few different scenarios, such as what tuition would cost if I attended the same school as planned, but just without the room and board costs, and if the cost of community college would be a better deal given that I would have to stay at home for my first semester.”

Though there are still a lot of questions to answer, Amy feels more confident because of the comparative information she was able to access through Money Path.

“I definitely felt more comfortable knowing what my options were and having the ability to create a detailed plan for any situation that I face come fall semester,” Mandy said. “I would recommend all students to look into using this to have a better idea of what their financial future will look like based on what they choose to do after high school.”

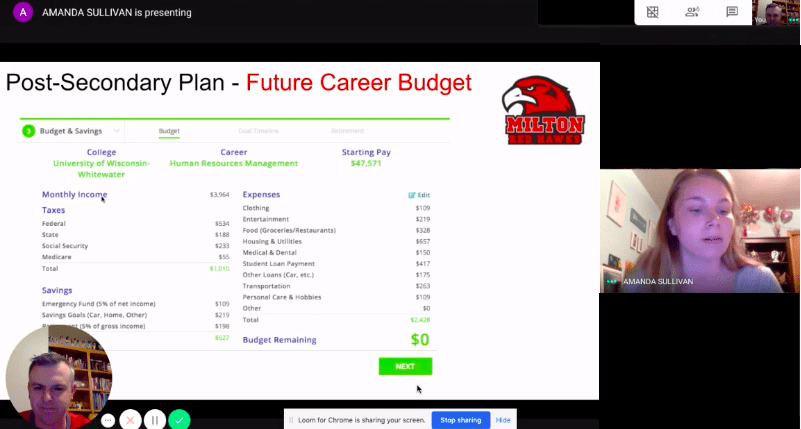

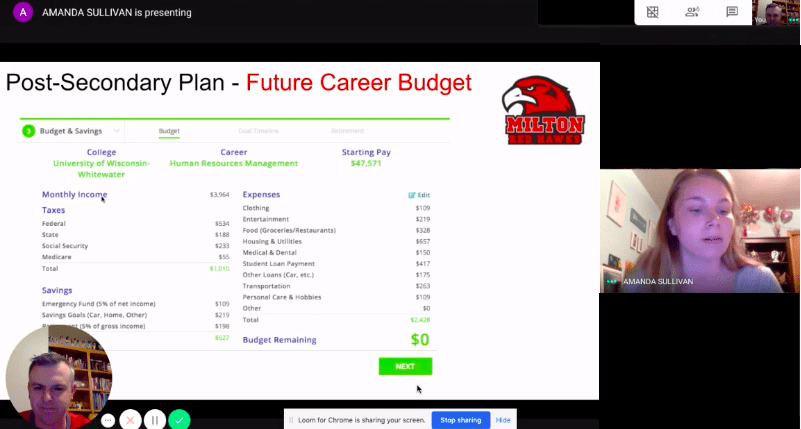

Mandy Sullivan presents her Academic Career Plan via Zoom, with teacher Nic Manogue