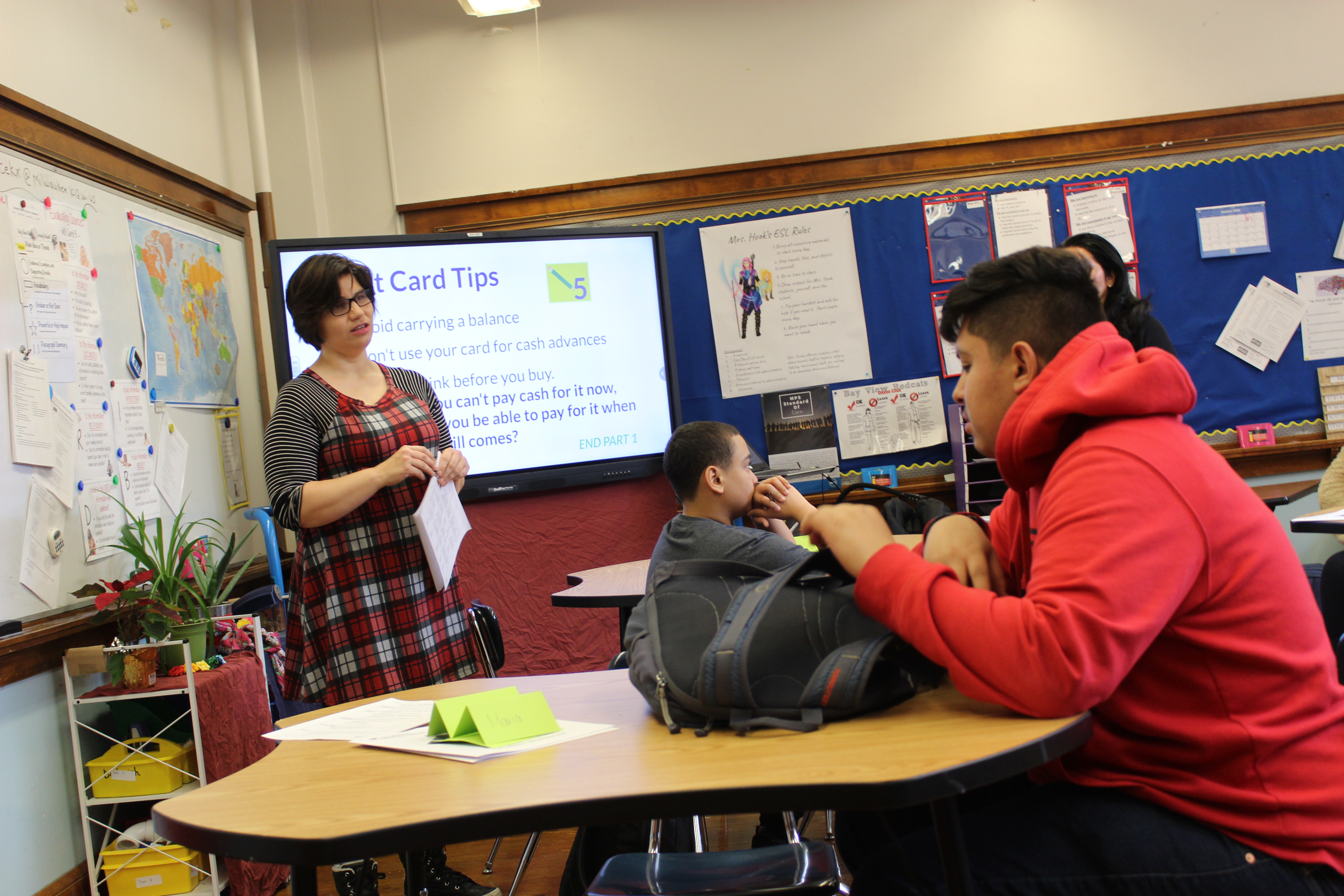

Educator Spotlight: Kelli Hook

For Kelli Hook, her passions for teaching English as a second language and financial literacy go hand in hand.

Kelli has taught English Language Learning (ELL) throughout her 20 year career as an educator, so she is deeply familiar with the specific pedagogical approaches that are most helpful to those developing their English skills as they learn. This is her first year bringing SecureFutures’ Money Sense program into her ELL classroom at Bay View High School, and she’s created a unique approach to incorporating the lessons into her broader curriculum.

Students in Kelli’s classroom speak first languages including Urdu, Arabic, Spanish, and Hmong. Because each student comes into her class with a different first language and a different level of English knowledge, Kelli has to ensure that learning is customized to students’ individual needs. She consistently checks in with students through self-evaluations in which they gauge their understanding of what they’re learning.

Students in Kelli’s classroom speak first languages including Urdu, Arabic, Spanish, and Hmong. Because each student comes into her class with a different first language and a different level of English knowledge, Kelli has to ensure that learning is customized to students’ individual needs. She consistently checks in with students through self-evaluations in which they gauge their understanding of what they’re learning.

Kelli also does pre-teaching before each SecureFutures session, using supplementary materials that she has developed to familiarize students with basic financial concepts and vocabulary. This ensures that they are prepared to dive into the more involved Money Sense curriculum while also expanding their English skills.

“I create a foundation and explicitly pre-teach vocabulary,” Kelli said. “If I teach financial concepts to them at their proficiency level and they have a base understanding, when the volunteer comes in and presents it at a higher level linguistically, not only are they getting the concept reinforced but she’s also helped bridge that gap into English. So it’s actually helping them improve their English skills as well.”

Over the past year, Kelli has worked consistently with SecureFutures volunteer Christine Smyth. Because of the unique learning environment of an ELL classroom, the two have learned to work closely as a team to meet students’ needs. Christine and Kelli are also planning a field trip for the class which will includes a tour of Christine’s workplace, US Bank, a college visit to MATC, and a discussion with a small business owner about entrepreneurship.

Over the past year, Kelli has worked consistently with SecureFutures volunteer Christine Smyth. Because of the unique learning environment of an ELL classroom, the two have learned to work closely as a team to meet students’ needs. Christine and Kelli are also planning a field trip for the class which will includes a tour of Christine’s workplace, US Bank, a college visit to MATC, and a discussion with a small business owner about entrepreneurship.

Though the main purpose of Kelli’s class is English language learning, it’s important to her that her students learn life skills as well. She appreciates that SecureFutures’ Money Sense program offers the opportunity for both.

Kelli has also observed that the information taught in Money Sense is important not just for the students but for their parents and other family members as well. Immigrant communities and those for whom English is not a first language often experience barriers to accessing banking and other financial resources, but knowledge can help break down some of those barriers.

Kelli has also observed that the information taught in Money Sense is important not just for the students but for their parents and other family members as well. Immigrant communities and those for whom English is not a first language often experience barriers to accessing banking and other financial resources, but knowledge can help break down some of those barriers.

“These kids are actually going home and teaching their families these things,” Kelli said. “Some are distrustful of the system because they’re undocumented. Others are coming from financial systems that are very different. They’re coming from cash economies or corrupt governments. So when they come here, the idea of credit or a bank, trusting someone else with your money – can be scary. So they definitely need some extra support.”

Kelli hopes to create an evening financial literacy program that is open to students’ parents as well, with interpreters. She plans to use SecureFutures’ curriculum materials, which she believes can be easily adapted for adult learners.

Most importantly, Kelli is always thinking about her students’ futures.

“I want them to be able, as they go out on their own independently, to make good decisions,” she said. “They’re going to make mistakes – everyone does! But I want them to have a foundation.”