Wisconsin Education Leaders Hear from Students of One-Of-A-Kind Finance School

December 4, 2015

Before you give money to someone else, “pay yourself” with savings. Teaching a teen to budget benefits them the rest of their lives. And if you can keep your credit score close to 800, that will help you out in the future.

Those were three of the student lessons Thursday from presentations to the Governor’s Council on Financial Literacy ahead of its regular meeting at James Madison Academic Campus (JMAC). The Milwaukee Public School has the only finance-oriented high school campus in the state, dually enhanced by participation in multiple Make A Difference – Wisconsin financial literacy programs and fervent involvement in a trio of National Academy Foundation learning paths. Make A Difference founder Lloyd Levin is a council member on the state financial literacy board and joined JMAC leaders in inviting the governor’s group to see the one-of-a-kind campus.

JMAC Principal Gregory Ogunbowale led the transition to concentrate on finance education and careers at the school of 762 students upon his arrival at JMAC a few years ago in an effort to expose teens to the wider world and hopefully “nurture proficient learners.” In particular, Principal Ogunbowale praised Make A Difference volunteers and program leaders for their “tenacity” in engaging students on the real-world power of personal finance.

About a dozen Governor’s Council members and representatives heard from a range of freshmen and sophomores on JMAC’s N.A.F. finance academy lessons, which range from the history of money to maintaining the highest credit score possible (“An 800, if I can,” said one freshman.) Afterward, JMAC senior Venita Grandberry shared her experience in the Make A Difference – Wisconsin Money Coach program. The first eye-opening lesson for Venita came from a new perspective on budgeting. Through her Money Coach lessons, her volunteer taught her that saving money means you “pay yourself first.”

Venita paid herself in the class with a savings goal of money toward a car to provide transportation from school and to jobs. In the long-term, Venita, a social and easy-to-smile senior, said her budgeting and savings habits now come naturally.

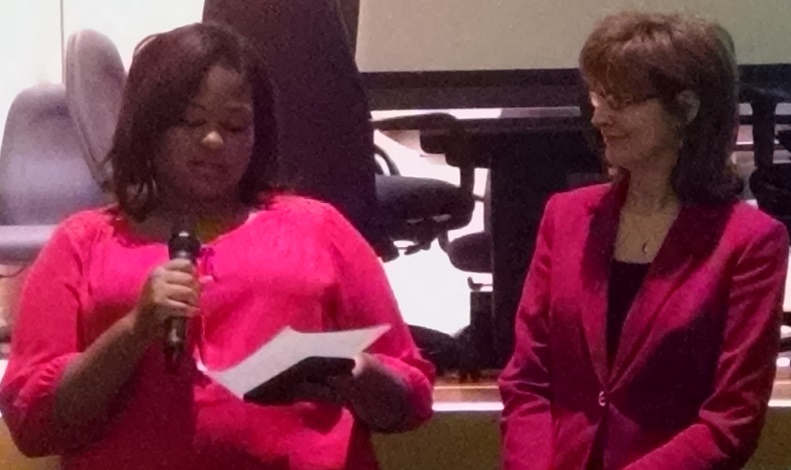

“They make it a fun way of learning about money. Money Coach is a great program because it can benefit you when you are managing money in the future,” said Venita, pictured at left with Brenda Campbell, Make A Difference – Wisconsin President and CEO.

George Althoff, communications director for the state’s Department of Financial Institutions, remarked that JMAC’s focus on finance should garner attention from other schools and fiscal institutions across Wisconsin.

“What is happening here should be celebrated,” Althoff said.