Teaming up to empower a school

March 21, 2017

Shaleah was skeptical. A junior at James Madison Academic Campus (JMAC), Shaleah wasn’t so sure that banks were able to protect customers’ money from something like a robbery or computer hacker.

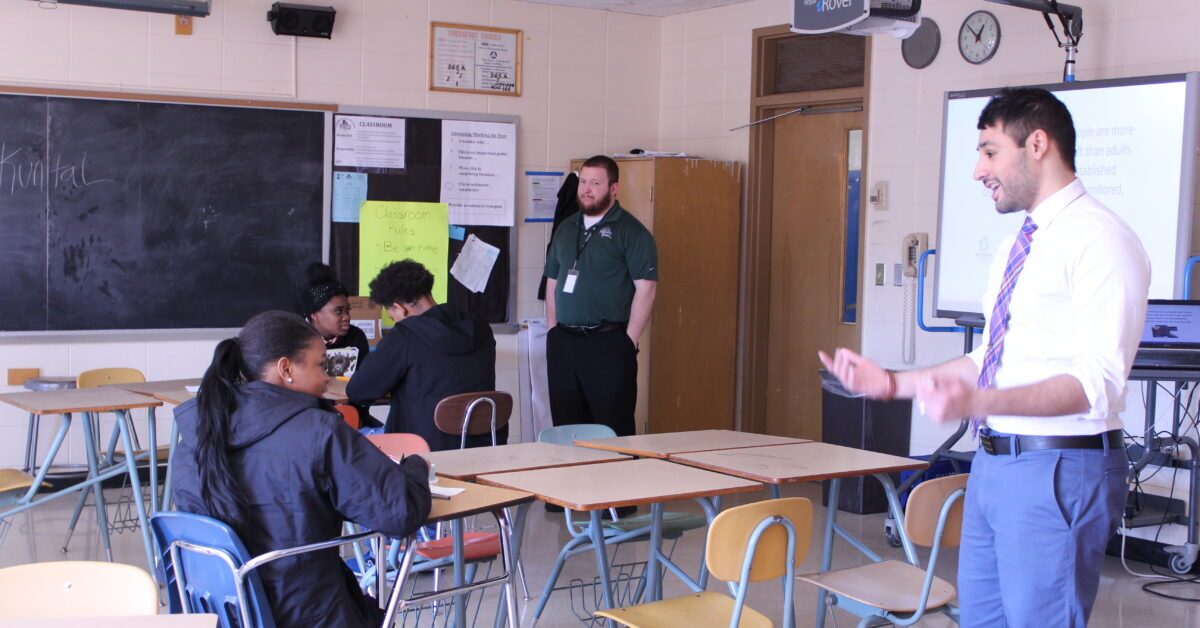

Kuntal Patel let his fellow financial education volunteer take the lead on a lesson on banking and checking as he talked one-on-one with Shaleah (at left, seated and talking with Patel) to share a clearer overview of the FDIC and other consumer protections.

Wells Fargo, where Patel works, decided to work with a group of employees interested in leading financial literacy lessons and focus their efforts on a class of students at JMAC. For Patel, this led to his first volunteering experience, which in turn brought on some personal finance myth-busting and a few laughs with Shaleah and her classmates.

“It was helpful. I didn’t know any of this,” Shaleah said after the class, held during Joshua Cheek’s algebra classes.

Patel and his Money Sense co-volunteer Chad Kolberg were part of a team of Wells Fargo volunteers who spent time at JMAC over the last few weeks in a concerted effort to “empower a school.” In all, dozens of students at the MPS high school were involved in engaging lessons on banking, budgets, saving, credit and loans. While our mission is always carried out by compassionate members of the business community, the “empower a school” model involves numerous members of one organization who are committed to a school or neighborhood.

For Wells Fargo, it’s also a potent version of the support they’ve shown our financial empowerment nonprofit since we began in 2006. Over the past decade, more than 60 volunteers have come from various divisions at Wells Fargo, which has also been a sponsor of the Investment Conference, an investor strategy event that serves as our major annual fundraiser. Combined, that volunteering and support has brought financial skills and resources to hundreds of teenagers at schools and sites in and around Milwaukee.

To say nothing of the fun had during the recent block of Money Sense sessions at JMAC.

“We’re having a blast,” said Kolberg, also a first-time volunteer.

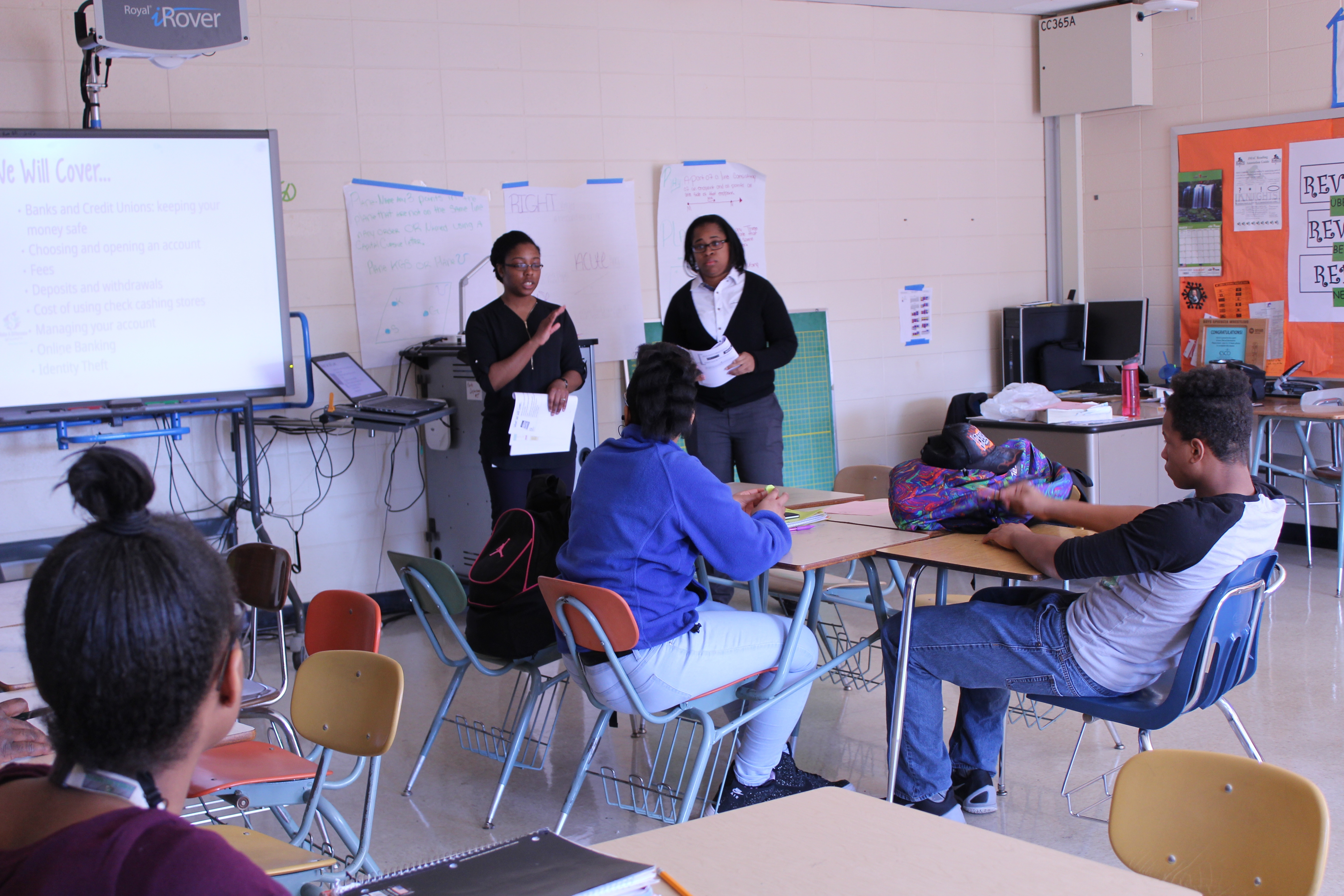

In a class later that day at JMAC, Kellcy Anderson, a client service consultant, and Tianna Polzin, asset management, asked for a show of hands. How many students had a bank account? A handful of students raised their hands. Another student admitted to using a check cashing store from time to time because he didn’t have a checking or savings account.

Polzin asked for students with accounts to share benefits – Jalen, a junior, really liked an app tied to his checking account – and then pointed to a few considerations for those other teens who are looking to begin banking.

“It doesn’t make sense to have to drive 45 minutes to talk to a personal banker,” said Polzin (pictured at right explaining alongside Anderson).

Is your company or department interested in bringing financial education to a specific high school or neighborhood? Email Pat Rorabeck, program director, to see how the “empower a school” initiative may work for your volunteering and financial education efforts.