Extra credit: timely lessons for students at Racine’s Case High School

May 15, 2017

Jill Rakauski started her volunteer financial education lesson at a Racine high school with trivia on May birthdays, including Stevie Wonder and Homer Simpson. The connection? Some of these students were hitting a milestone birthday – 18 – which often brings with it new financial considerations around credit cards.

“None of you have good credit. None of you have bad credit. You have no credit. But you will start earning it this year,” Rakauski said.

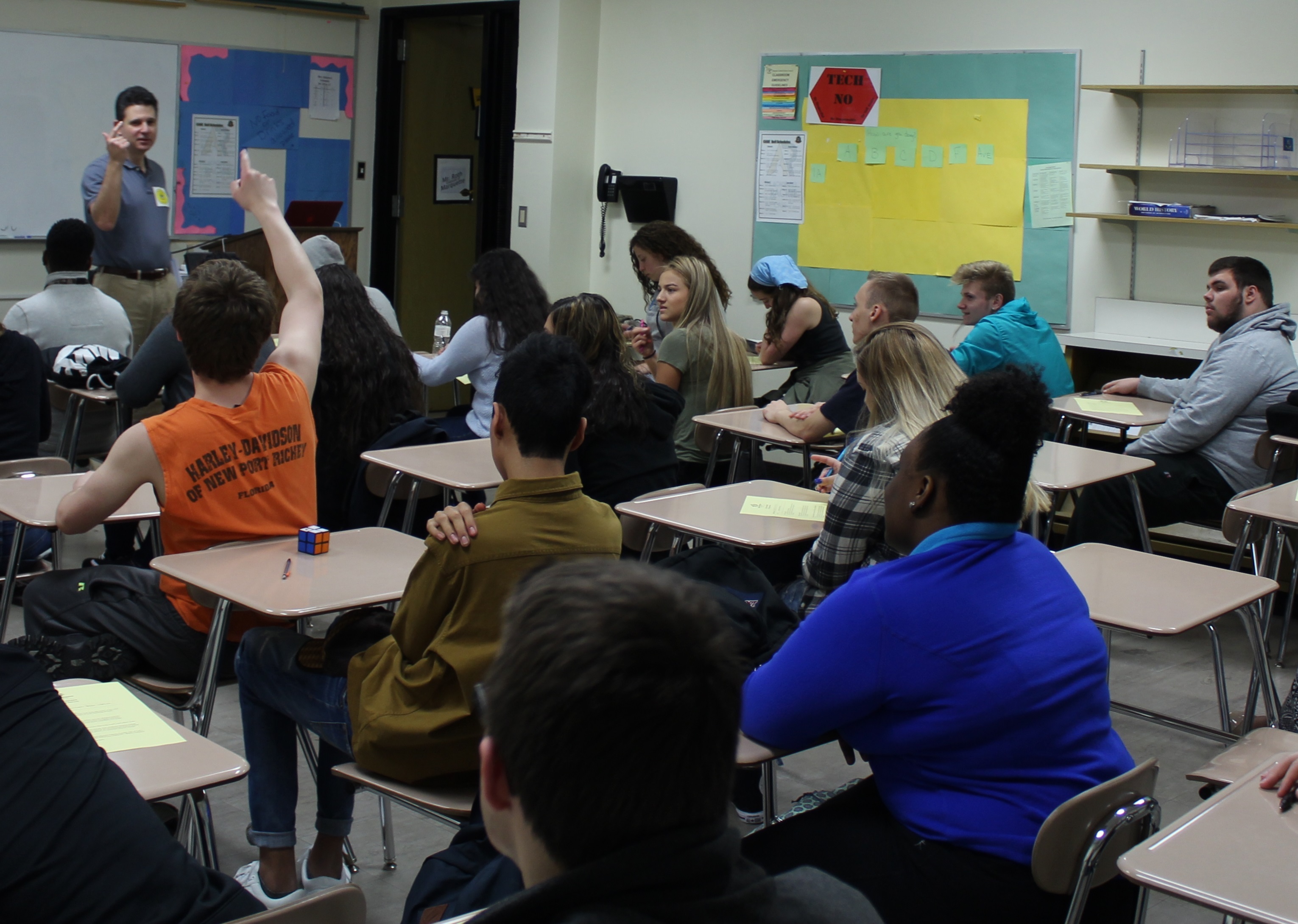

In May, a handful of volunteers from the Racine area led about 80 students through three separate Money Sense lessons at J.I. Case High School in Racine. Gene Taylor, an educator at Case H.S., brought the Money Sense lessons and volunteers to his students to supplement his economics course for juniors and seniors. (Taylor and Rakauski are pictured at left, respectively.)

In May, a handful of volunteers from the Racine area led about 80 students through three separate Money Sense lessons at J.I. Case High School in Racine. Gene Taylor, an educator at Case H.S., brought the Money Sense lessons and volunteers to his students to supplement his economics course for juniors and seniors. (Taylor and Rakauski are pictured at left, respectively.)

During Rakauski’s recent lesson, James, a senior, took on the moniker of “Mister Barker,” a loan officer, in an activity with his peers that evaluates good habits and credit risks. Earlier, Xena, 17, explained that her mother has a Discover card, although she didn’t really know the differences between credit cards ahead of a lesson that outlined as much. Oscar, 17, chuckled during one activity at the prospect of keeping “old furniture around” for 13 years because of the small dent made by minimum payments.

Rakauski, an attorney based in Racine, wanted students prepared, not scared, when it came to credit, credit scores and loans.

“Good credit brings you good things,” she said.

Barb McNulty, one of our premier volunteers, and a realtor in the Racine area, once again took pride in leading financial literacy lessons with her upbeat and personal style. Into the lunch hour, Peter Speca, a banking director at US Bank, (pictured at right) started his session with a review of what he called “the rip-offs” – those financial options that aren’t always in the consumers’ favor. Students were quick to reiterate his list, which included rent-to-own payment plans, pay day loan lenders and check cashing stores.

Barb McNulty, one of our premier volunteers, and a realtor in the Racine area, once again took pride in leading financial literacy lessons with her upbeat and personal style. Into the lunch hour, Peter Speca, a banking director at US Bank, (pictured at right) started his session with a review of what he called “the rip-offs” – those financial options that aren’t always in the consumers’ favor. Students were quick to reiterate his list, which included rent-to-own payment plans, pay day loan lenders and check cashing stores.

“I want you to remember these because I’d rather you kept your money. I want you to become a good financial manager,” Speca told students.