Most teens graduate high school without a solid financial education.

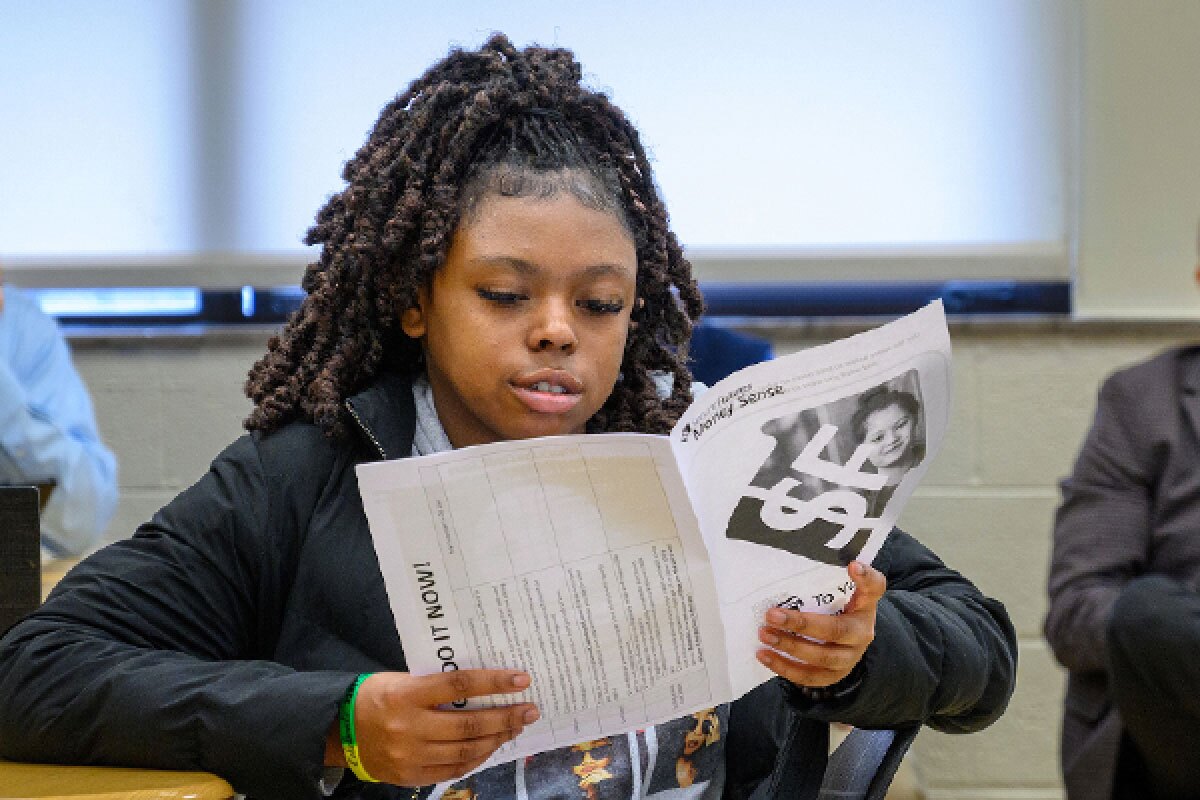

SecureFutures brings together volunteers, educators and supporters who share a belief in improving financial futures for teens in our communities through proven programs.

64%

Average score for teens on the 2025 National Financial Educators Council Literacy Test

Without adequate financial education, many adults struggle with money management.

46%

have not saved enough to cover an emergency

48%

of those with student loans are concerned they will not be able to pay them off

51%

are worried about running out of money in retirement

Source: FINRA 2018 National Financial Capability Study

How can financial education CHANGE A TEEN’S LIFE?

Listen to Antonio’s storyOur programs

How can you invest today?

SecureFutures is building stronger communities by empowering teens with financial education, tools, and mentorship. An investment in teen financial capability is an investment in the future.

-

Give your time:

- Volunteer and transform the lives of teens through financial education

- Join a committee

-

Funding opportunities:

- Support our programs

- Investment Conference sponsorship

- Become a monthly donor

-

Amplify our mission and impact:

- Become a social media ambassador

- Join our peer-to-peer awareness campaign

- Host an info session

- Connect us with a high school